Today CPD releases a new discussion paper on how business and investors can use scenario analysis in order to better understand and respond to climate-related risks and opportunities.

The paper, Climate horizons: next steps for scenario analysis in Australia, is co-authored by CPD Policy Director Sam Hurley and new CPD Fellow Kate Mackenzie.

It is now very clear that Australian companies and investors should consider and disclose the financial and economic risks that climate change poses. Scenario analysis – which considers how risks and opportunities might evolve under different climate and policy trajectories – is emerging as a crucial part of global best practice for identifying climate risks, disclosing them to markets, and responding to them through strategy and risk management.

The Financial Stability Board’s Taskforce on Climate-related Financial Disclosures recommended that scenario analysis should be a key priority for firms and investors around the world, while APRA’s Geoff Summerhayes emphasized the importance of scenario analysis to guide Australian responses to climate risks in his ground-breaking speech on climate change and the financial sector earlier this year.

However, achieving robust, consistent scenario analysis will be challenging, particularly while new practices and standards are emerging. There is a risk that inconsistent or flawed approaches could obscure more than they reveal, and that different users and stakeholders might develop very different expectations about what good scenario analysis looks like.

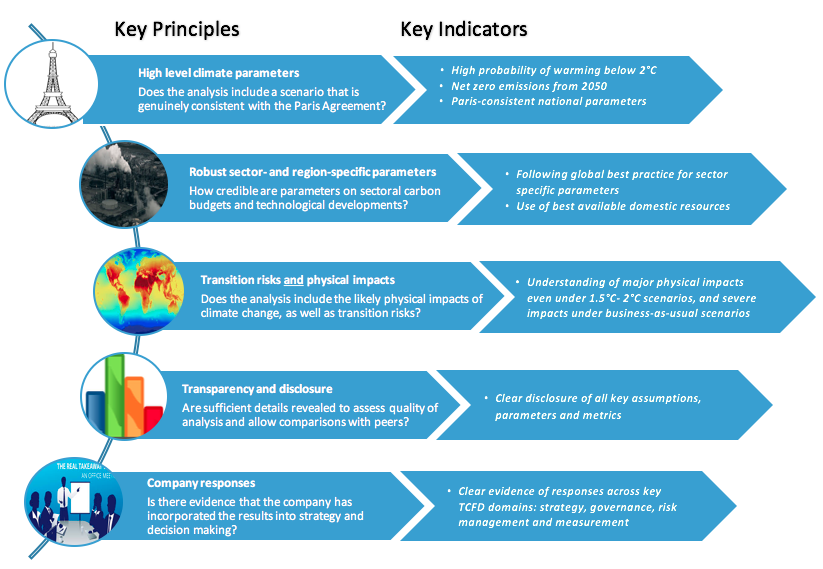

Climate horizons suggests five key principles that stakeholders can focus on as hallmarks of robust scenario analysis, as Australian responses to the TCFD take shape. Scenarios should:

- be genuinely consistent with Paris targets – incorporating a high probability of limiting warming to well below 2°C.

- include both transition risks and physical impacts from climate change. The latter is likely to be significant even if warming is kept be below 2°C.

- engage with the best available resources for understanding the sectoral or regional impacts of climate change.

- be transparent about assumptions and parameters used.

- show clear evidence not just of analysis of climate risks, but of responses to them through strategy, governance and risk management.

The paper also recommends key priorities for regulators: encouraging wide adoption of the TCFD framework in Australia, boosting their own capabilities to understand scenario analysis and climate risk, and co-operating more effectively to manage and monitor system-wide risks and impacts.

The paper is released to coincide with CPD’s Public Forum on Building a Sustainable Economy, where APRA’s Geoff Summerhayes, the CEFC’s Steven Skala, ANZ’s Christina Tonkin and new CPD board member Sam Mostyn will discuss how different organisations can help shape better near- and long-term responses to climate risk and other sustainability challenges.

CPD will use Climate horizons as a basis for stakeholder engagement and further research on scenario analysis over the next few months, leading towards a full report on this issue in mid-2018.

Key documents

|

|

|

|---|---|---|

| Full discussion paper | Executive summary | Media release |

Media coverage

Australia’s top companies ignore climate change, and we let them, Julien Vincent, The Sydney Morning Herald, 10 December 2017

Australian shareholders should be told of climate risks to profits, says think tank, Gareth Hutchens, The Guardian, 29 November 2017

Key links and related reading

CPD roundtable on directors duties, climate risks and sustainability, October 2016

Legal opinion on directors duties and climate change, Noel Hutley SC and Sebastian Hartford-Davis, October 2016

Australia’s new horizon: Climate change challenges and prudential risk, Geoff Summerhayes, February 2017

Carbon risk: a burning issue, Senate Economics References Committee report, April 2017

Final Recommendations Report, Task Force on Climate-related Financial Disclosures, June 2017

The wealth of nature: Increasing national wealth and reducing risk by measuring and managing natural capital, Institute of New Economic Thinking, Oxford Martin School and Smith School of Enterprise and the Environment, University of Oxford.