Investing for Australia – Clarifying climate risk expectations for the Future Fund

Investing for Australia is a report from the Centre for Policy Development’s Sustainable Economy Program. It follows previous reports and a broader stream of work on the management of climate risk in public authorities.

The report assesses the Future Fund’s climate risk management using publicly available information.

It uses established tools and compares the Future Fund’s climate risk approach to practices at other institutional investors, including other sovereign wealth funds.

The Future Fund is Australia’s main sovereign wealth fund (SWF). It invests on behalf of taxpayers. It gets capital from budget surpluses, and from the sale of Telstra. In 2022 the Future Fund had nearly a quarter of a trillion dollars under management.

The Future Fund is overseen by a board and it is broadly directed by an Investment Mandate and a Statement of Expectations issued by the Finance Minister, and it is required to maximise long-term returns relative to risk, and to adhere to international investment industry best practice.

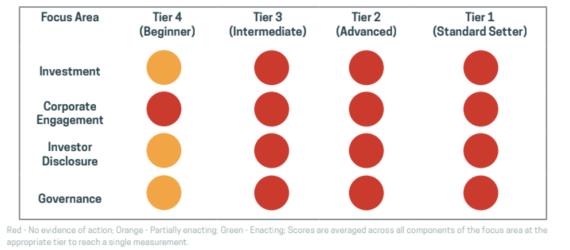

A review of the Fund’s publicly known activities using the ICAP Expectations ladder – an established industry tool, shows partial early stage practice typical of an investor “at the start of their climate journey”.

The report makes three recommendations to set the Future Fund on the path to climate risk leadership:

- Request published climate risk disclosure using global standards and emerging frameworks

- Ensure the Future Fund is covered by any new laws governing climate risk disclosure in Australia

- Set up an independent review by a panel of experienced investment professionals to consider changes to the Future Fund Investment Mandate or Letter of Expectations to align the Fund’s climate risk response with industry best practice