Full supplementary memorandum of opinion here

Today CPD has released an update of a landmark 2016 legal opinion on how Australian law requires company directors to consider, disclose and respond to climate change.

Summary of findings

The original Hutley opinion, which we commissioned and released in 2016 after extensive consultation with business leaders and legal experts, found that directors who do not properly manage climate risk could be held liable for breaching their legal duty of due care and diligence.

The supplementary opinion, provided again by Noel Hutley SC and Sebastian Hartford Davison on instruction from Sarah Barker at MinterEllison Lawyers, reinforces and strengthens the 2016 findings. It emphasises five material developments since 2016 that have elevated the need for directors to consider climate risks and opportunities and reinforced the urgency of improved board-level governance of this issue. These five developments are:

Coordinated engagement by financial regulators on climate: The opinion highlights recent

statements on climate risk by APRA, ASIC and the Reserve Bank as evidence of “striking” alignment between Australia’s regulators on “the financial and economic significance of climate change.”

New reporting frameworks: The opinion highlights three major advances in financial reporting frameworks relevant to the disclosure of climate risk: the final recommendations of the Taskforce for Climate-related Financial Disclosures; new recommendations on assessing climate risk materiality from the Australian Accounting Standards Board and the Auditing and Assurance Standard Board; and updated guidance on climate disclosures from the ASX Corporate Governance Council.

Investor and community pressure: The opinion notes that “investor and community pressures concerning climate risk are becoming more acute”, highlighting shareholder actions on corporate climate targets and disclosures and co-ordinated efforts by institutional investors to target improvements by major emitters.

Advances in scientific knowledge: The opinion recognises “notable developments in the state of scientific knowledge that bear upon the gravity and probability of climate risks which directors need to consider.” These include comprehensive information and evidence presented by the IPCC’s 2018 special report on global warming of 1.5 degrees.

Increased litigation risks: The opinion cites important developments relevant to litigation risks, including advances in “event attribution science” that can identify the link between climate change and individual extreme weather events.

The advice concludes that: “In our opinion, these matters elevate the standard of care that will be expected of a reasonable director. Company directors who consider climate change risks actively, disclose them properly and respond appropriately will reduce exposure to liability. But as time passes, the benchmark is rising.“

The full supplementary opinion, along with a CPD media release and other supporting documents are available below.

Key documents

|

|

|

| Hutley opinion 2019 | Hutley opinion 2016 | CPD Media Release |

|

|

|

| APRA timeline of key developments | Climate Risk primer for directors |

Key quotes from 2019 opinion

“[W]e are now observers of a profound and accelerating shift in the way that Australian regulators, firms and the public perceive climate risk. There has been a series of coordinated interventions by Australian regulators, which will require in practice that increased attention be given to both the assessment and disclosure of climate risk. There has been acute interest in these issues from investor groups. There have been developments in the state of scientific knowledge. In our opinion, these matters elevate the standard of care that will be expected of a reasonable director. Company directors who consider climate change risks actively, disclose them properly and respond appropriately will reduce exposure to liability. But as time passes, the benchmark is rising.”

“The regulatory environment has profoundly changed since our 2016 Memorandum, even if the legislative and policy responses have not. These developments are indicative of a rapidly developing benchmark against which a director’s conduct would be measured in any proceedings alleging negligence against him or her.”

“It is apparent that regulators and investors now expect much more from companies than cursory acknowledgement and disclosure of climate change risks. In those sectors where climate risks are most evident, there is an expectation of rigorous financial analysis, targeted governance, comprehensive disclosures and, ultimately, sophisticated corporate responses at the individual firm and system level.”

“It is obvious that the risks differ, depending whether the transition is implemented gradually or abruptly. It is also obvious that the longer that it takes to implement appropriate transition measures, the greater the risk of an abrupt policy response. But the fact that there is a wide range of available outcomes will not excuse inaction”

“It is increasingly obvious that climate change is and will inevitably affect the economy, and it is increasingly difficult in our view for directors of companies of scale to pretend that climate change will not intersect with the interests of their firms. In turn, that means that the exposure of individual directors to “climate change litigation” is increasing, probably exponentially, with time.”

Media coverage

Directors’ climate liability exposure increasing ‘exponentially’, Ben Potter, Australian Financial Review, 29 March 2019

Climate change raising company liabilities, barristers warn, Peter Ryan, ABC RN The World Today, 29 March 2019

Related reading

Climate change and the economy, speech by RBA Deputy Governor Dr Guy Debelle, March 2019.

Climate change, speech by ASIC Commissioner John Price, June 2018

The weight of money: a business case for climate risk resilience, APRA Executive Member Geoff Summerhayes, November 2017

Heavyweights now speaking with one voice on climate change risks, Sam Hurley, The Age and The Sydney Morning Herald, 24 March 2019

Time for an Australian Sustainable Finance Taskforce, Travers McLeod and Sam Hurley, Sydney Morning Herald, 22 July 2019

CPD roundtable on directors duties, climate risks and sustainability, October 2016

Policy impact and implications

The original Hutley opinion and subsequent interventions on climate by financial regulators hosted by CPD have been part of a step-change in Australian responses to climate risk. APRA has repeatedly cited the Hutley opinion as one of the key developments that have led the prudential regulator to demand more sophisticated and concerted responses to climate risk. Similarly, ASIC has emphasised that the Hutley opinion reflects its understanding of the law and reinforces the case for “probative and proactive” consideration of climate risks.

Public statements on climate risk by APRA, ASIC and the Reserve Bank – hosted by CPD in 2017, 2018 and 2019 respectively – have significantly raised awareness and expectations on corporate responses to climate risk, and demonstrated greater focus and co-ordination between regulators on this key challenge.

While understanding of the materiality of climate-related risks has increased in recent years, many leading Australian institutions are still doing far too little to analyse and disclose these risks and respond accordingly.

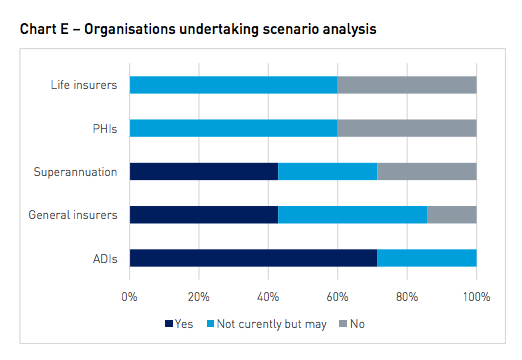

Recent evidence points to a fragmented and inconsistent approach to climate risk governance and reporting. A September 2018 review by ASIC found that only 17% of 60 ASX 300 companies surveyed by ASIC had disclosed climate material climate risks to their business, and that broader voluntary disclosures were often “fragmented”, “too general” and “not comprehensive enough” to be useful for investors. A March 2019 survey by APRA found that while awareness of climate risk was increasing, only seven of 38 respondents from the banking, insurance and superannuation sectors had disclosed risks in line with the TCFD framework – and almost half did not intend to use the framework in future. APRA also found that only one-third of respondents had conducted climate scenario analysis, despite clear signals that using these scenarios is a critical element of a sophisticated response to climate risk:

The fact that climate risks are becoming more pronounced makes slow progress translating talk on climate risk into action all the more concerning. Since the original Hutley opinion was released in 2016, Australia’s failure to accelerate emissions reductions and a prolonged period of policy inconsistency and uncertainty have made climate risks more significant and have increased the prospect of larger and more abrupt impacts and adjustments in future.

These trends have made governance and decision-making challenges for company boards on climate even more pressing. While the Hutley opinion makes a clear case that considering and disclosing climate risks is already required under existing Australian law, fragmented responses by companies so far strengthen the arguments for more onerous, mandatory requirements. As we argued in CPD’s Climate Horizons report in 2018:

“Strong stakeholder support for the TCFD recommendations reflects a broader consensus that getting consistent, accurate information on climate risk exposures into the marketplace is necessary to limit dangerous global warming and promote financial system stability. Regulatory and shareholder pressure to adopt the TCFD framework will drive better practice. Yet the need for better information is urgent, because time to respond to critical climate risks is short. Tougher responses must be considered, including more rigorous mandatory reporting requirements, if the TCFD approach fails to deliver quickly.”

Regulators themselves have acknowledged that expectations for better climate risk reporting are likely to be matched by more onerous mandatory requirements. In February 2019, APRA Executive Member Geoff Summerhayes, in his capacity of Chair of the global Sustainable Insurance Forum, noted that:

“[R]egulators’ current stance of merely encouraging climate-risk disclosure will inevitably harden towards making such disclosure mandatory.”

Australian policymakers should carefully consider the case for strengthening mandatory climate-related disclosures, and revisit other key recommendations from the Senate inquiry into carbon risk in 2017.

In addition, the government should seize the opportunity to review directors and fiduciary duties on climate and other sustainability issues in the context of a much more sophisticated and strategic global approach to green and sustainable finance. While the legal position of directors is critical and climate-related disclosures are a key issue, it is also vital to recognise these developments are part of a much wider shift in expectations – at a global scale – towards more sustainable business, finance and regulation. These shifts are creating major challenges and opportunities for businesses, regulators and ultimately policymakers. In many other parts of the world, including European Union, United Kingdom, Canada and New Zealand, issues like directors duties and disclosures are being considered as part of systematic reviews and action plans for sustainable finance which are seeking to seize this momentum and rewire financial and governance practices to deliver better long-term outcomes. In Australia, representatives from major banks, insurance funds, insurers and industry groups announced this week that they have formed an industry-led Australian Sustainable Finance Initiative to provide a roadmap for realigning finance with social, environmental and economic goals. To get the best outcomes, it is critical that policymakers are also engaging directly with a rapidly-changing landscape on sustainable finance.